Investing

Eastbank wants to work with like-minded institutional and private investors to provide good yields and to buy and let decent, affordable homes.

Your investment is secured against London real estate assets that we have expertly located.

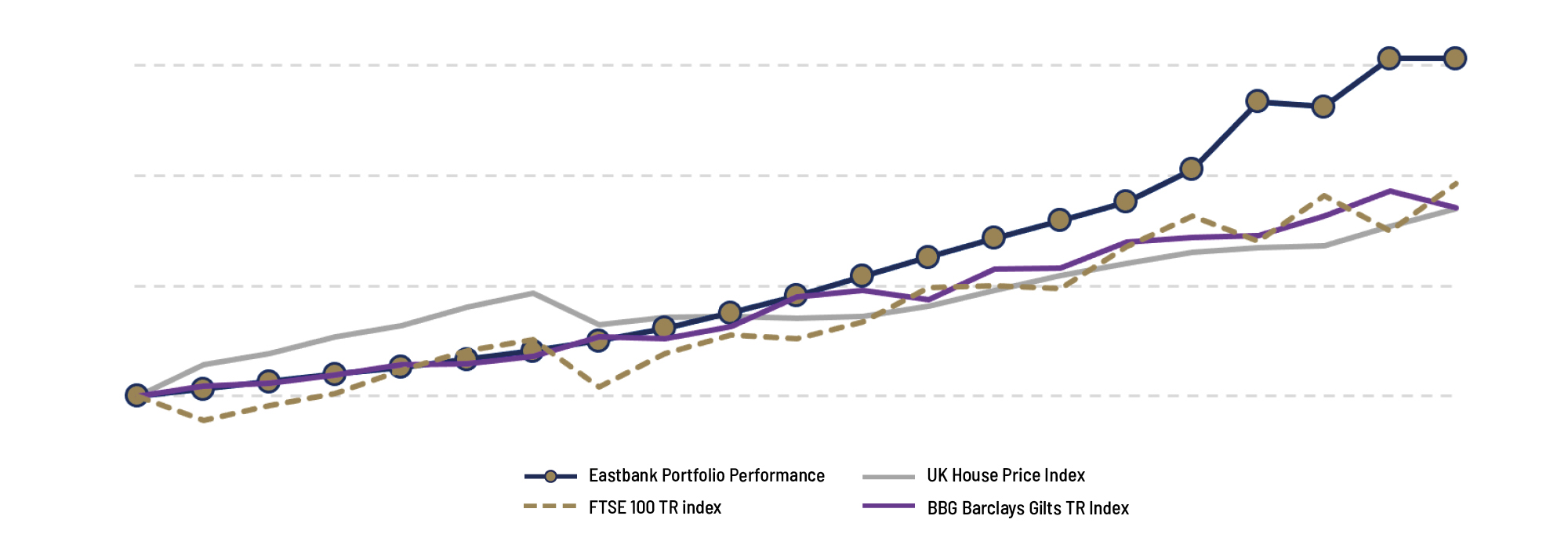

In addition to working on behalf of our investors, we also put our own capital into the projects. Our track record shows we can deliver consistent returns as well as create cost effective developments.

Eastbank’s methods are reliable, level-headed, and well-considered – knowing what to buy, sell or keep.

We have both the knowledge and the expertise, which is underpinned by our passion for building, restoring, and seeing our developments through to become a successful and profitable asset.

Invest with us in mortgage backed London real estate